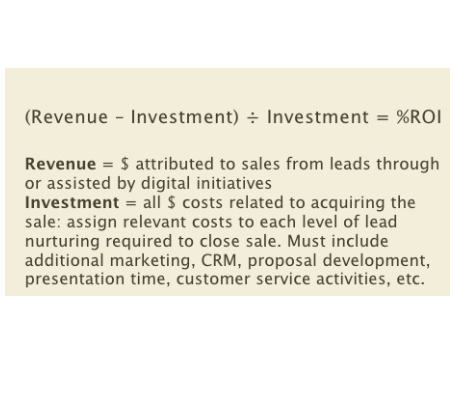

For optimal payment results, an invoice should include a full outline of the payment terms, the due date of the payment, and banking details to enable the client to complete the payment. If additional fees will be applied for a late payment, the invoice should include this stipulation as well. Freelancers often enjoy greater flexibility and diversity in their work, which is one of the draws of this approach to employment. Those who are self-employed get to be their own bosses, which also means assuming all responsibility for income taxes, business expense deductions, and other bookkeeping tasks. However, it’s possible to manage these ongoing duties with an organized system for invoicing and bookkeeping.

By staying on top of deductions and expenses throughout the year, you’ll be able to maximize your tax savings come tax season. Freelancing is a work arrangement where individuals offer their services to clients without being tied to a single employer. Freelancers are self-employed and have control over the projects they take on, their working hours, and location.

Use a Professional Setup

It may take you hours to prepare profit and loss statements, but an accountant can do it fairly quickly. They will be well aware of the tax laws and tax-saving opportunities. However, you can save their fee by collecting all fiscal data together. Share the cash flow statements, so your accountant needs less time to work on them.

Although freelance accountants in the U.S. are not required by law to have any specific credentials, it’s worth getting a CPA (certified public accountant) qualification. The role is often confused with that of a bookkeeper, but they are quite different. A bookkeeper keeps track of day-to-day financial matters, monitoring cash flow, and maintaining records. An accountant may do all of these things, but they will also provide in-depth analysis of a company’s finances, prepare financial statements, and act as an advisor on financial matters.

A good accountant will know how to resolve this math completely and give you precise financial results. If you have chosen a new accountant, it is important to find out the details and documents you will need to provide them with. Anyone can do it, but choosing a certified professional to do it for you for the ‘peace of mind’ factor. In simple words, a Certified Public Accountant is an accountant, but an accountant may not be a CPA. A CPA has to meet the special education and experience required to pass the examination and is licensed by one of the 50 states of the US. PCMag.com is a leading authority on technology, delivering lab-based, independent reviews of the latest products and services.

Questions to ask before choosing a business and personal expenses accountant

We ensure that anyone working on a freelance basis is utilising their income correctly, and we work hard to make the process of running a successful business painless and stress-free. Don’t let your accounting and bookkeeping woes bring you down, join QAccounting today and benefit from two decades of experience. Maintaining a budget is a great way to manage your finances efficiently. However, your monthly budget covers much more than your business expenses. A budget must include savings, investments, miscellaneous expenses, and taxes. You can even use the zero budget technique, which is a flexible way to manage your money as it tracks your budget monthly and creates specific expenditure heads based on your income.

When you are the only person managing everything about your business, it can actually be easier for you to stay organized, as there is no middle man and potential miscommunication risk. Accountant for freelancers Bookkeeping is all about keeping track of your financial transactions. For digital filing, have properly labeled folders and for offline management of documents, do the same physically.

New exco ready to take Safrea forward – Bizcommunity.com

New exco ready to take Safrea forward.

Posted: Thu, 10 Aug 2023 08:48:57 GMT [source]

But there’s something important being lost in all of this – and that’s the accounts. However, hiring an accountancy firm will take more weight off your shoulders and allow you to focus on bringing cash flow into your business. Full service packages for sole traders, LTD companies, and small businesses. Helping freelancers decide whether to go with a limited or umbrella company.

Business

Cash flow management revolves around regulating the funds entering and leaving your business. This supervision allows you to maintain a healthy balance, ensuring your business can cover its operational costs and future investments. As a self-employed business owner, mastering cash flow management is critical for your venture’s longevity and profitability. Some freelancers are VAT-registered, which brings with it enhanced reporting requirements. Each quarter, HMRC will expect a VAT return, which can be confusing and time-consuming to keep on top of. We will process your VAT returns and keep HMRC in the loop on your behalf – meaning you don’t have to spend time preparing them every three months.

If you find it difficult to do this on your own, then yes, it is time to hire an accountant – organization is the fundamental aspect of bookkeeping! Something you can do to make sure your filing system works is opting for online invoicing software that will manage your invoice statements for a small monthly fee. A professional can also provide you with better strategies to manage your accounting and can help strengthen your financial gains. Nonetheless, hiring an accountant is only beneficial if the scale of work is high enough to accommodate the need for an accountant. There are multiple considerations you need to make when hiring an accountant for freelancers.

Strategies

This means that nowadays, freelancers have greater opportunities to find work and grow their businesses faster. With over a thousand dedicated accountants and bookkeepers using the site to find work, Fiverr is one of the best platforms to connect with accounting professionals. Fiverr’s name comes from the original price for all services being just $5, which makes it clear why it’s our pick for a budget-friendly site. An affinity with numbers is obviously the main requirement for a freelance accounting career, but the more qualifications you have, the more marketable you become.

Company and national insurance setup, Freeagent software, bookkeeping, etc. One of our tax experts can do a quick estimate of how much you should pay and send a payment in with the extension. Then at least you don't have to worry so much about the interest and penalties. You can stay in contact with an accountant all around the year to resolve all sorts of financial queries and complexities. A major reason you should hire CPA's is that they save your time and offer great precision.

Missteps in this area can lead to serious financial and legal implications. This blog post explores common property accounting errors that property investors make and offers practical advice on how to prevent them. At QAccounting, your monthly package with us will include a dedicated account manager who will take the time to listen to you, and understand who you are and what you do. A freelancer is a self-employed individual who carries out shorter-term projects on an ad-hoc basis for various different clients.

Experienced

Our top tested performers provide all the tools and features freelancers need to keep a tight rein on their finances, without costing them fortune. On the conrtary, for clients who’d like to simply pass all the financial matters to an experienced accountant, you can use more encompassing terms like “small business accounting” or “tax season support”. As a freelancer, you work alone with zero supervision, that’s why it’s well-suited for professionals who feel very confident in their accounting and bookkeeping skills.

- We hope that by offering some tips and advice, succeeding as a freelance accountant or bookkeeper will be much easier.

- If you need more services related to your business transactions, such as bookkeeping, managing balance sheet, and other accountancy services, you can look for that too.

- UpStack has a diverse talent pool that’s highly scalable depending on the size and scope of your business.

- You can tailor our packages and personalise our services as much as you’d like with QAccounting.

It is important to find out beforehand, who will prepare your taxes. For more than a decade, Jonathan has focused his New York City CPA practice on helping freelancers and the self-employed. Collaboration with clients can mostly happen through software and file access. Try to automate as much as you can, especially all the repetitive and monotonous tasks in accounting. On the flip side, personalize the elements that matter to you, whether it’s your working space or your work routine. It’s not easy to solely depend on your willpower, that’s why creating habits is a sustainable method over a long time that supports reaching your goals.

Wave similarly lets you export transactions as XLS and CSV files and sales receipts in a ZIP file. This is another area where you don't want to guess—and lose a reimbursable expense. If you are all about the miles and don't need a heavyweight accounting service, you should definitely check out QuickBooks Self-Employed's mobile app, which automatically logs your miles as you drive.

- People tend to focus on their income, but it is their expenses that play a critical role in managing their finances.

- We offer the opportunity to save 50% of your business cost by hiring Finland Accounting freelancers.

- Our team of industry-leading freelancer accountancy specialists, tax specialists, and client managers work alongside freelancers like you every single day.

This software makes your accounting easier, more accurate, and less time-consuming. First things first, whether it’s an accounting or any other freelance job, there are elements of the freelancer’s job that are common to all. You have to be prepared for the risks that come along with being self-employed. We provide advice and reviews to help you choose the best people and tools to grow your business. This can give potential clients a sense of your skills and how you can help their business. It's also an opportunity for you to understand their needs and offer tailored solutions.

Bookkeepers should not call themself as an accountant unless they have Certified Public Accountant(CPA). With zero experience a person can make their self-employment as a bookkeeper. They don’t need any Certified Public Accountant (CPA) to start their freelancing career as a bookkeeper. Irrespective of accounting, bookkeeping can be done by both accountants and non-accountants. The proliferation in online communication means you can easily hire a top-notch accountant from the other end of the country – perfect if you find a freelance specialist you want to investigate. You shouldn’t employ an accountant who isn’t a paid-up member of proper professional bodies.

Fusion Accountants serve hundreds of freelancers and provide simple accounting and tax services for contractors in different industries. The variety of fixed monthly packages allows you to choose the best plan for your needs so you don’t have to pay for services you don’t need. On top of that, Fusion Accountants work with premium accounting software including Xero and Quickbooks. Sunrise is a good choice for freelancers and sole proprietors who need to track income and expenses and invoice customers. It might also appeal to small businesses that need double-entry accounting but not time tracking, robust reports, or full mobile access.