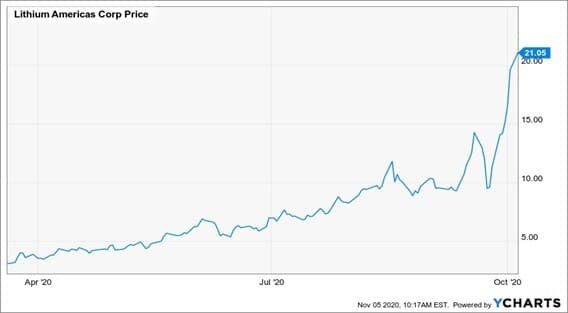

In the lower-left of the chart, the Alligator opens up, and an uptrend remains in place for some time. This is followed by a buy signal to the upside, which results in a brief uptrend. As the price pulls back, the Alligator is sated, and then it opens again for a big uptrend. This is followed by an extended sideways period, in which the indicator lines crisscross back and forth. This is a sleeping phase, and most traders are best to stay away.

- When a moving average with a shorter period breaks above a moving average with a longer period, it’s a buy signal.

- Let me explain how to trade with Bill Williams’ Alligator indicator.

- In trend-following strategies, the Williams Alligator is used to identify the direction of the trend and take positions in the direction of the trend.

- In principle, the Alligator technical indicator is a combination of Balance Lines (Moving Averages) that use fractal geometry and nonlinear dynamics.

- If the moving average moves upwards, it signals traders that there is a strong uptrend and signals them to place long orders.

- If the interest of the participants of the market doesn't weaken, then red AlligatorsTeeth begins to react after green, and the slow blue AlligatorsJaw line always develops the last.

The Alligator will chase the price far away and offer a decent profit to a trader. Having eaten enough, the Alligator goes back to sleep (moving averages converge), so it's time to take profit. When it rises above other MAs, the indicator signals a formation of a bullish move (1). When it breaks below other MAs, the alligator predicts a bearish move (2). Once the trend is established, the moving averages follow it, moving up in an uptrend and down in a downtrend.

How the Williams Alligator is Calculated

Further, it is possible to use each following fractal on a trend for an additional entrance. The dynamic trailing on lines allows to catch a short-term impulse, but to leave in time in case of its end. On a turn or transition in flat there is the reverse crossing of lines, but it is obligatory – according to the same scheme. Gradually lines are developed in a necessary order, the distance between them increases (the period of «hunting» opens).

To adapt the technical analysis indicator to different timeframes and markets, you should adjust the parameters (certain price periods and shifts) of the moving averages. You can also trade with the default parameters, but, in this case, you should trade in longer timeframes from H4 to D1. The theory says traders should use 2-3 signals of different technical analysis tools, including indicators, candlesticks, and chart patterns, before entering and exiting the trade. A trader could go short, but additional tools would be required to exit the market with a profit. For example, a trader could have opened a sell position when the alligator provided a sell signal (1).

Trading platforms

72% of retail client accounts lose money when trading CFDs, with this investment provider. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider https://day-trading.info/which-forex-pairs-move-the-most-the-most-and-least/ whether you understand how this product works, and whether you can afford to take the high risk of losing your money. However, it's crucial not to get fooled and enter the market without confirmation.

I should note that the longer is the timeframe, the more reliable are the signals generated. And vice versa, the shorter is the timeframe, the more there will be signals, but a false buy or sell signal will be more often to occure. The Fractals indicator perfectly complements the Alligator.

Adding the Alligator Indicator to Metatrader

The financial markets spend 70-80% of trade time in the range without the obvious direction and only 20-30% − in a condition of a trend optimum for profit. First, analyze the stage of the Alligator cycle – if it is sleeping, waking or eating. If the Alligator is falling asleep, exit the trade before start losing money rapidly. Do not trade forex or other market when the Alligator is sleeping. Critics argue that Alligator was developed for the stock market a long time ago.

Alligators Exposed to PFAS Show Autoimmune Effects NC State … – NC State News

Alligators Exposed to PFAS Show Autoimmune Effects NC State ….

Posted: Thu, 20 Oct 2022 07:00:00 GMT [source]

The direction in which all three of them move signifies the current market trend. The Alligator Indicator is a trend-following indicator designed to identify the beginning and end of market trends. It is based on the concept that financial markets exhibit periods of both trending and ranging behavior, much like an alligator that alternates between sleeping and hunting. The indicator comprises three lines that represent different moving averages and their relationships with each other.

Interpretation of Williams Alligator

Thus, the indicator helps traders predict the future movement in the medium and long term, but with speculative actions and increased volatility, the quality of the signals drops sharply. The most common, effective, and straightforward way to use the Williams Alligator technical analysis indicator is to trade crossovers of the lips and jaw of the alligator. When the green line crosses below the blue, it’s a bearish sell signal, and when the blue line crosses above the green line, it’s a bullish buy signal. This strategy is less risky than other methods, but can often leave some profit on the table by playing it safe.

However, it's one of the most reliable indicators in the forex market. No matter how good the indicator is, you always need to get confirmation of a signal. Let's take a look at the indicators you can use together with the Alligator. https://currency-trading.org/education/do-you-fall-for-these-day-trading-traps-tips-to/ As the Alligator stands for the trend indicator, it's worth combining it with another trend indicator but the one that uses a different methodology. It'll help you avoid fake signals that often appear in times of the sideways market.

How to Confirm Alligator Signals

Stay on top of upcoming market-moving events with our customisable economic calendar. The indicator https://trading-market.org/what-does-the-future-hold-for-ux-and-ui-designers/ was developed by American author Bill Williams, who first wrote about it in 1995.