Depending on what information you want to find out, there are different types of moving averages to use. The exponential moving average (EMA) is a type of moving average that gives more weight to more recent trading days. This type of moving average might be more useful for short-term traders for whom longer-term historical data might be less relevant.

- Though EMAs are also weighted toward the most recent prices, the rate of decrease between one price and its preceding price is not entirely consistent.

- The time frame or length you choose for a moving average, also called the “look back period,” can play a big role in how effective it is.

- For example, an MA with a long time frame will react much slower to price changes than an MA with a short lookback period.

- Moving averages are widely recognized by many traders as being indicators of potentially significant support and resistance price levels.

- Instead, prices zig-zag and moving averages are a fantastic tool that helps traders smooth out all these random price movements.

The EMA reacts faster when the price is changing direction, but this also means that the EMA is also more vulnerable when it comes to giving wrong signals too early. For example, when price retraces lower during a rally, the EMA will start turning down immediately and it can signal a change in the direction way too early. The SMA moves much slower and it can keep you in trades longer when there are short-lived price movements and erratic behavior. But, of course, this also means that the SMA gets you in trades later than the EMA.

Best Moving Average Settings for Crypto Trading

As we learned previously that MA should help us reduce the “noise” in the market, having a small time frame does not reduce the noise. This is because, in its calculation, the EMA gives more weight to the most recent price action and less weight to older price action. When the price changes direction or spikes/dips, the EMA recognises this sooner, while the SMA takes longer to turn when the price turns. If you want to discover more on how to read moving average and learn about different types of trends to level up your trend trading game, you can read all about them here.

Moving averages are widely recognized by many traders as being indicators of potentially significant support and resistance price levels. If a stock does fall below a support level, that can be considered a short-term sell signal. Alternatively, if a stock rises above a resistance level, that can be considered a short-term buy signal. The moving average crossover method is one of the most commonly used trading strategies, with a shorter-term SMA breaking through a longer-term SMA to form a buy or sell signal. The death cross and golden cross provide one such strategy, with the 50-day and 200-day moving averages in play. The bearish form comes when the 50-day SMA crosses below the 200-day SMA, providing a sell signal.

Weighted Moving Average (WMA or LWMA)

But even as swing traders, you can use moving averages as directional filters. The Golden and Death Cross is a signal that happens when the 200 and 50-period moving https://currency-trading.org/education/the-main-differences-between-forex-and-crypto/ average cross and they are mainly used on the daily charts. It can be a clean and simple way to understand when a stock is trending and to analyze the market.

It's true, indicators are usually always calculated and plotted nicely onto the graphs for a user. However, by understanding how each moving average is calculated, it will help traders identify the right MA to use, and know what settings to tweak so it yields more accurate results. It is mainly because it smoothes out price action and prevents short-term price fluctuations by filtering out the “noise”. This means it’s essentially calculating the average of the highs and lows of the price for a set number of periods, using historical data from price movement. This is plotted alongside the price on a line, and it constantly updates itself as the price changes.

These are the 2 most popular moving averages that investors commonly use:

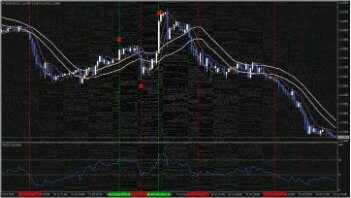

Before you know what exponential moving averages are, you should first know the basics of moving averages. Marty Schwartz uses a fast EMA to stay on the right side of the market and to filter out trades in the wrong direction. Just this one tip can already make a huge difference in your trading when you only start trading with the trend in the right direction. When price action tends to stay above the moving average, it signals that price is in a general UPTREND. One sweet way to use moving averages is to help you determine the trend. The chart below highlights the strategy in action, with the price falling below the 20-day SMA on the top left, indicating the switch from bullish to bearish sentiment.

How much did Jack Ma’s speech cost Ant Group? About $230 billion – CNN

How much did Jack Ma’s speech cost Ant Group? About $230 billion.

Posted: Mon, 10 Jul 2023 10:20:00 GMT [source]

Whereas a long-term MA (like 200 EMA) will let you ride long-term trends. If the price is above the 200 EMA and 200 EMA is pointing higher, then the market is in a long-term uptrend (of your given https://trading-market.org/10-best-futures-brokers-for-commodity-trading/ timeframe). In the financial market, no one can predict accurately how an asset can move. In many instances, people who try to predict the future prices without any analysis fail.

Moving Average Crossover

The gravity of the moving averages brings the price back to the mean. The angle of the two faster moving averages and the difference between them will indicate if the price has enough speed to break away from its average. The best moving averages for determining momentum are from 5 to 40 EMA. For example, a trader may choose 5 and 10 EMAs, or 10 and 20 EMAs, or 20 and 40 EMAs at the close.

Do your homework, do your backtest, develop confidence in your trading ability then patience will follow and you are good to go. This is the way to trend trade, all traders I known who are successful trend follow. Because MAs utilize past prices instead of current prices, they have a certain period of lag. For example, a moving average that analyzes the past 100 days will respond more slowly to new information than an MA that only considers the past 10 days.

The Benefits of Good Crypto App For Traders

Larger data sets benefit long-term investors because they are less likely to be greatly altered due to one or two large fluctuations. Short-term traders often favor a smaller data set that allows for more reactionary trading. This tool uses market data and analyzes each coin based on 15 Moving Averages and 10 Oscillators. The main goal of the tool is to predict further crypto price trends or direction and help traders decide where to go in and out of trades.

Once the indicator is on the chart, begin testing the Fibonacci numbers to look for the Natural Moving Average. In the example above, we calculated both the SMA and EMA with 10 days’ worth of data. The higher value from the weighted average compared to the simple average suggests that stock prices are rising.

- There have been several crossovers by the 50-day and 200-day moving averages over the past several years, and trading these signals may not have aligned with your objectives.

- A moving average simplifies price data by smoothing it out and creating one flowing line.

- The signal line, which is the EMA of the MACD series, has a time period of ‘c’.

- It's true, indicators are usually always calculated and plotted nicely onto the graphs for a user.

- Lag is the amount of time it takes for a moving average to cue a possible reversal (change in a security’s price direction).

- Both are used in technical analysis and can be interpreted in the same manner to even out price variations.

This indicator is an indicator that traders usually use to determine when is the best time to open or close the position. These are loved and used by many investors and traders, as they can help to determine various patterns and trends, allowing to build trading strategies based on the received information. As the S&P 500 chart above shows, US stocks are currently trading above their 50-day (light blue line) and 200-day (orange line) EMA. Both moving averages may be support levels going forward and, in fact, the 50-day moving average has acted as support several times over the past couple months.

Web Trader platform

The primary purpose of moving averages is to smooth out the data you're reviewing to help get a clearer sense of the trend. The most popular EMAs are 12 and 26-day EMAs for short-term averages, whereas the 50 and 200-day EMAs are used as long-term trend indicators. When used in conjunction with other indicators, EMAs can help traders confirm significant market moves and gauge their legitimacy.

The differences between the SMA, WMA, and EMA aren’t very significant at first sight but they do give different signals on the chart. Let’s look at what the charts tell us now that we have explained the different types of Moving Averages. This results in a faster-moving MA, responding faster to the latest price action than a traditional SMA line does. You can avoid moving average trading during the situations mentioned above in which moving average trading is not as successful. Now we will discuss some disadvantages of moving average trading that you can weigh against the advantages for a successful trading experience. The upper half of the chart contains the daily closing price (blue line), 12 day EMA (red line) and the 26 day EMA (green line).

It's important to understand that the SMA and EMA are each based on substantially different concepts of time. Although the Weighted Moving Average is theoretically interesting and produces reasonable numbers, there are very few advocates https://day-trading.info/fxtm-review-2021-is-fxtm-a-scam-or-legit-forex/ of it as a practical everyday analytical tool. Once lag is introduced, things can quickly get close to high school math complicated. Nonetheless, it is easy to get a relatively deep executive level grasp of the concepts.