Content

Detection risk is the risk that the audit procedures used are not capable of detecting a material misstatement. This is especially likely when there are several misstatements that are individually immaterial, but which are material when aggregated. The outcome is that the auditor would conclude that there is no material misstatement of the financial statements when such an error actually exists.

To understand the audit risk model, consider the tale of a villain. Detection risk is the risk that the auditing procedures may fail to detect error or fraud, such as sampling error. Compliance and risk management are key to ensure the proper functioning of your business. Inherent risk is higher when there’s estimation or transactions have layers of complexity. In other words, audit risk is the result of what the company does (or does not do) and what the auditor does (or does not do). Control risk is that arises from a business’s failure of internal control mechanisms.

Importance of Audit Risk

The probability that audit procedures (2nd umbrella) may not detect material misstatements is detection risk. The probability that the financial statements may include material misstatements is audit risk. The new audit risk model remains a critical tool for auditors to evaluate the risk of material misstatement in a company's financial statements.

- For starters, intense planning and strategizing in every department and every process of auditing must come into play.

- Control risk is that arises from a business’s failure of internal control mechanisms.

- They’ll also need to look at external factors like government policy and market conditions, as well as financial performance and management strategies.

- Risks of material misstatement (RMM) is the product of inherent risk and control risk.

- The audit, therefore, provides (1 – .05) assurance that the financial statements are free from material misstatement.

- Later, Jennifer was primarily responsible for working with clients to design high-caliber, customized training programs.

With a greater understanding of the controls and procedures put in place, auditors can then pinpoint the areas where risks are higher. Audit firm generally are insured against audit risk and potential legal liabilities. The audit risk model is a fundamental framework used by auditors to evaluate the risk of material misstatement in a company's financial statements. It provides a structured approach to assess and manage risk during the auditing process.

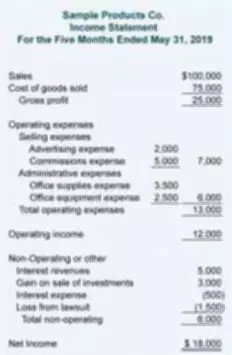

Example of Audit Risk

Audit risks help driving the audit in the right direction and help in setting the risk appetite of the audit procedure. Audit risk also helps auditors in laying down the audit strategy for a particular organization. Since some transactions are more prone to theft or error, companies need internal controls to prevent or detect misstatements. Over the course of an audit, an auditor makes inquiries and performs tests on the general ledger and supporting documentation. If any errors are caught during the testing, the auditor requests that management propose correcting journal entries.

To do this, an auditor will look at the client’s business, operations and financial activities. They’ll consider external factors, financial performance and the organisation’s internal strategies. Once an auditor knows the inherent and control risks of your business, they can go on to calculate the detection risk—which is the risk of not detecting a misstatement. If your organization has high inherent and control risk, then the auditor knows there is a higher risk of misstatements.

Audit Risk Example and Application

We will explore the Audit Risk Model, describe how each component in the model affects the cost of an audit, and describe methods you can implement to decrease your risk moving forward. Get my free accounting and auditing digest with the https://www.bookstime.com/articles/audit-risk-model latest content. Inherent risk is what a transaction is (independent of related controls). A villain (inherently a thief) desires to make his way into your home. You have locks on your doors and an alarm system (controls, if you will).

Detection risk is one of three elements that comprise audit risk, the other two being inherent risk and control risk. Detection risk is the chance that an auditor will not find material misstatements relating to an assertion in an entity’s financial statements through substantive tests and analysis. All businesses hope to receive an unqualified opinion, which happens when an auditor determines that financial records are clean and free of any misrepresentations. With automation software, businesses can reduce their inherent risk and control risk, making the audit risk model easier to manage when it comes time for an auditor to perform their job. When control risk and inherent risk level are assessed to be kept as high by the auditors, the detection risk is low to maintain the total audit risk level at the required level or acceptable level.